The

VIEW OUR TRAVEL PHOTO ALBUM >

January 21, 2026

The AI Future for Portfolio Operations:“It’s not hard to imagine an AI sitting on the investment committee…” Nik Kapauan joined Access Holdings in 2022 as a Managing Director on the Value Creation team. As a member of the team, Nik supports the firm’s thesis development, origination, execution, and portfolio management activities. He also leads Access’ […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

November 18, 2025

At the start of 2024, I wrote a post advising Operating Partners to keep their heads down and hold onto good seats. The market felt seized up. Activity was sluggish, and the client base was understandably cautious. Many firms were struggling to sell assets, and cost centers — including portfolio operations — were under review. […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

October 30, 2024

How does a firm know that it has the right person in the leadership chair for the Portfolio Operations team? I occasionally get asked this question and TBH there’s not one foolproof way to answer it. Many factors will influence your decision, but perhaps keep in mind some of the below points and themes. As […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

January 8, 2024

Having done this work for almost 20 years now, I do enjoy being able to watch the market for Operating Partners evolve as the macro cycles begin and end. Nothing is permanent in this game. The period between 2005 and 2008 were heady days for the function. We had the tailwinds of a great market, […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

November 20, 2023

One reason that I enjoy doing work across Private Equity portfolio operations is that the mandates are rarely ever carbon copies of one another. The beauty of an Operating Partner is that every firm, and dare I say every deal team inside every firm, can define an Operating Partner in their own novel way. It […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

April 18, 2023

Like many of you, I’m a movie buff. I’m a sucker for great storytelling and hold many of the Classics in a special place. As a guy who grew up in Youngstown, Ohio in the 1980s, the mob movie genre has particularly held my attention. No surprise then, The Godfather trilogy is a long term […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

January 16, 2023

In December, I spent time with multiple clients who were in the process of thinking through their 2023 budgets. Each of them runs a Portfolio Operations team inside a PE firm. The firms for whom they work are quite different… ranging in AUM from $4 billion to $350 billion, and many in between. They were […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

November 2, 2022

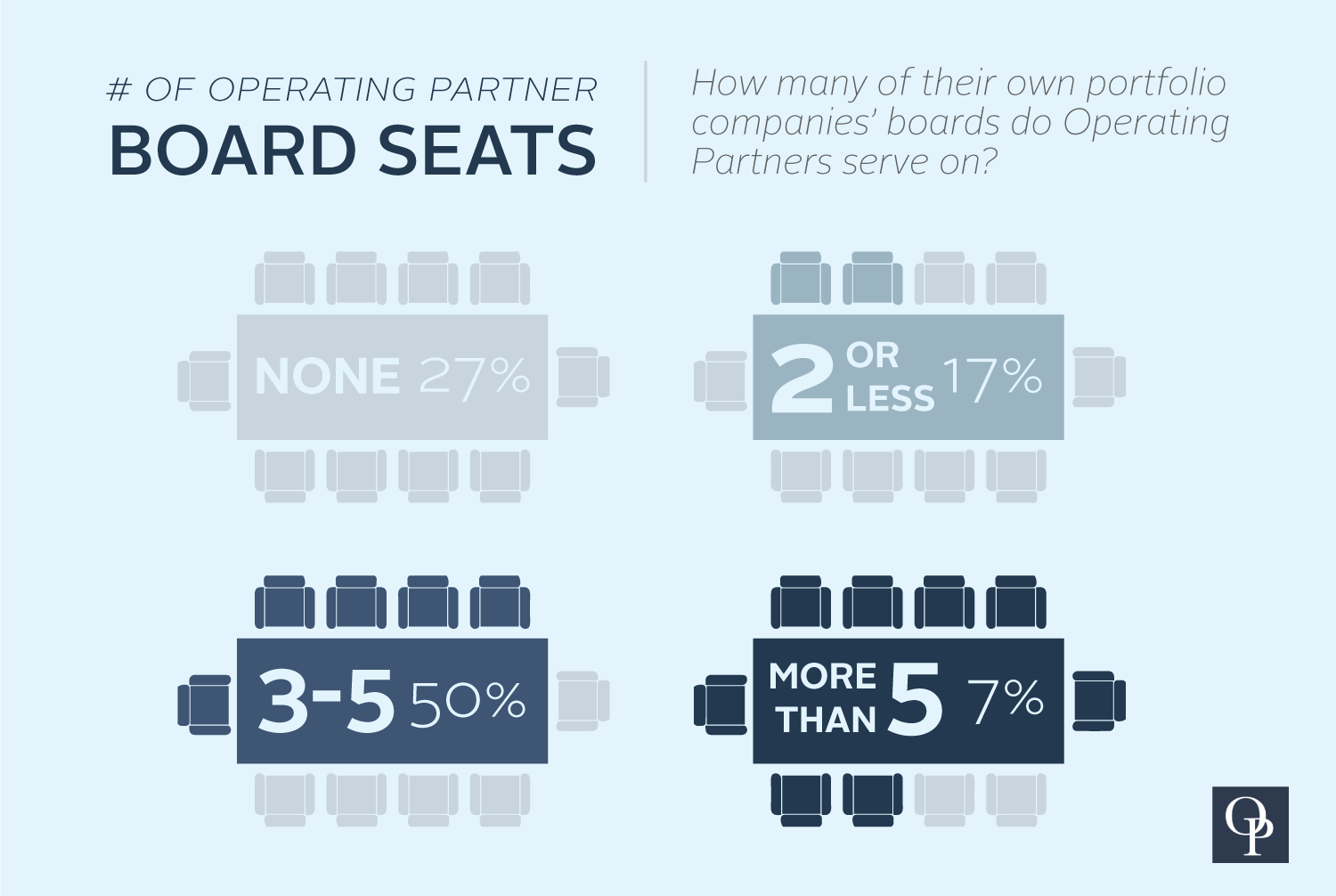

And How can that Dynamic Impact Firm Culture? “Do your Operating Partners take Board seats, or not?” I feel like this is one of those questions in our community which doesn’t always necessarily elicit an authentic answer. I don’t mean that people are untruthful in their responses, but I do think they may be following […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

September 14, 2022

This Spring I was working on a big assignment searching for someone to run the internal Portfolio Operations Group for a top 5 blue chip firm. It was likely the most impressive deal I’d ever had, and it garnered a tremendous amount of interest from the candidate community. I had the attention of both F500 […]

The

VIEW OUR TRAVEL PHOTO ALBUM >

November 8, 2021

Now that I have drawn a line in the sand around the superiority of housing industry specific Operating Partners alongside the deal teams who focus on those sectors, I need to examine the reasons why I arrive at this conclusion. I’ll start at the macro level, and progress down with more granularity as we dive […]